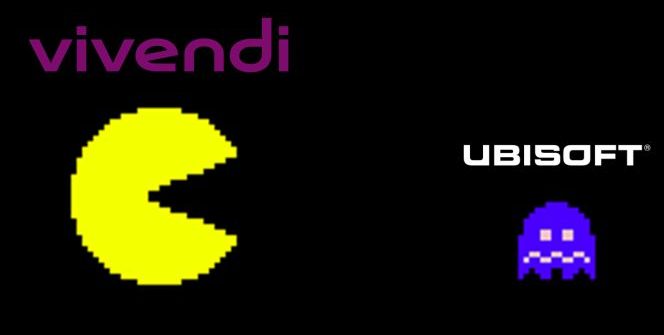

Yves Guillemot doesn’t want Vivendi to take over his company (as they have already done so with Gameloft).

Ubisoft is doing everything it can to don’t allow the media giant, led by Vincent Bolloré, to take the game developing/publishing company over. Therefore, Guillemot has bought back no less than four million shares, supported by several Ubisoft shareholders. These shares are being retired, which means they can not be purchased anymore. With the shopping, the Guillemot-family is up to 14% of the shares (and 20% voting rights), which is still off from Vivendi’s 27% and 24%, respectively.

The 27% of owned share amount is close to the 30% limit, where the French law would require Vivendi to place a bid on Ubisoft, or they’d have to drop below 30% to comply. There’s also the Florange law: any shares held by the same entity for two years will mean double voting rights for that share. Vivendi first bought 6.2% in October 2015… and they might trigger the hostile takeover from November 23 because of it!

If Vivendi is serious about taking over, the company would have to pay a LOT, as the Ubisoft share prices are on the up (by no less than 5.24% since the buyback announcement…). The shareholders behind Guillemot, as well us, would not like to see Ubisoft disappear in its current form.

Source: WCCFTech

![[TGA 2025] Star Wars: Galactic Racer Focuses on High-Stakes Podrace Runs [VIDEO]](https://thegeek.games/wp-content/uploads/2025/12/theGeek-Star-Wars-Galactic-Racer-302x180.jpg)

Leave a Reply